US Election 2024: What Trump’s Win Means for European Tech Companies

Following my European and American tech peers I feel a slight bit of insecurity to what the election results may bring for tech companies selling their product in the US.

The biggest objective that may come to one’s mind selling in America issurely are possible tariffs and penalties for tech companies selling their proudly “Made in Europe” product into the proud “Buy American” market

How Will Trump’s Tariffs Affect European US Sales?

So let’s cut right down to it and see what impact the new President elect will have on your business.

First and foremost, let me tell you – no matter who the president elect is, a good product always wins over new customers hearts.

It is important to take into consideration that the Biden-Harris administration did not really undertake a whole lot to ease the tariffs – especially on Chinese goods – that were imposed by their predecessor.

This impressive 25% tariff on Chinese goods surely shook suppliers and customers alike, but at the same time this also brought a massive window of opportunity for customers to steer the focus from price competitiveness to quality and reliability first.

High-Tech vs Commodity

In my role as Executive for a US tech company selling Austrian technology, I came across numerous occasions of resellers, OEMs and customers praising the need for high-quality components to make their applications last longer. This is for a product that is highly technical and offers substantial benefits to automation, power distribution, HVAC and automation technologies.

On the other hand, picture your product to be a rather simple, basic component in the automation world. Things may look different here. Big US distributors and OEMs started charging their clients an extra fee to offset the additional fees and duties due to the price-driven nature of such commodities.

Slowly but surely, consumers started accepting that hefty 25% price adjustment to balance out the tariff imposed by the President. And once more people where tasked to pick between price point or just upgrade their product through a minimal surcharge to get the highest possible quality.

Case Study: Power Supply Import Tariffs

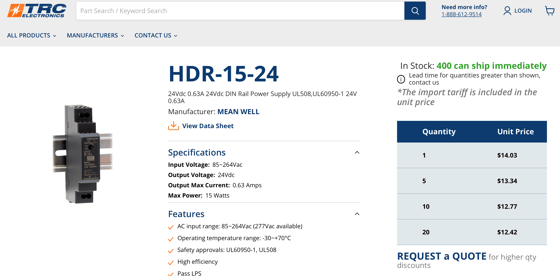

One specialist distributor of powert supplies is a company called TRC Electronics out of the swing state of Pennsylvania. In the early stages of the Trump tariffs, TRC Electronics would show an extra line in their invoices to highlight the 25% tariffs. As the customer journey made it through the next administration, the power supply specialist started including the surcharge in the product price, as shown in the graphic for a common HDR-15-24 power supply by Taiwanese manufacturer Meanwell (product manufactured in China) below.

What Makes A Product Truly Competitive?

It is without a doubt that a hefty tariff can eat up all profit margins, especially when dealing with distributors or resellers alike. In order to overcome such hurdles, it is important to have a highly competitive product, unique value proposition, and an attractive price point to offer the client the overall package to possibly cover the cost for any imposed tariffs.

While it is always worth considering new go-to-market setups, it is equally important to look at an evolving customer need to match one’s value proposition and show value through performance.

In a recent blog post, we also explore and dive deep on questions and bullet points to find out if your value proposition is ready to tackle any possible new imposed tariffs without having to worry about moving your entire production.

Check out this link to explore key factors that can drive your product’s competitiveness.

Photocredit: https://gdb.voanews.com/d71050e3-c94d-4d82-a6da-e06a38fa64b8_w1080_h608.png